loan programs

Preview our variety of loan offerings

Conventional Standard

An affordable financing option with standard requirements

- Loan amounts up to $806,500

- DTI up to 50%

- Minimum down payment 3%

Fannie Mae HomeReady

The perfect fit for clients with limited down payment capabilities

- Loan amounts up to $806,500

- DTI up to 50%

- Primary Residence

Freddie Mac Home Possible

An affordable mortgage option for low-to-moderate-income individuals

- Loan amounts up to $806,500

- DTI up to 50%

- Primary Residence

Conventional High Balance

Qualify homebuyers seeking properties exceeding the standard limits

- Loan amounts up to $1,209,750

- DTI up to 50%

- Primary, Secondary homes & investments

VA Standard

A loan solution for veterans, active-duty service members, and their eligible surviving spouses

- Loan amounts up to $2,000,000

- Gift Funds are allowed

- No down payment required

VA IRRRL

A streamlined refinance option for veterans and active-duty service members

- Loan amounts up to $1.5 million

- No appraisal or credit underwriting required

- Primary residence, investments, second home

FHA Standard

Qualify home buyers with limited down payment capabilities

- Loan amounts up to $524,225

- DTI up to 55%

- Little as 3.5% down on 1-4 Units

FHA High Balance

A mortgage option allowing for larger loan amounts in high-cost areas

- Loan amounts up to $1,209,750

- DTI up to 50%

- Primary, Secondary homes

DSCR

An investment property loan that closes in an LLC, and quick.

- Credit for DSCR > 1.25

- No income no employment

- Short term rentals up to 80% CLTV

12/24 Month Bank Statement

A perfect fit for self-employed clients

- Personal, business, or combined bank statements

- Min. 3 months of reserves

- Flexible down payment options

1099 Only

An ideal loan for sole proprietors or contract individuals

- 1099's for the last 1 year

- 1-year history with the same employer

- Gift funds allowed

Asset Utilization

An ideal solution for borrowers with liquid assets: retirees, investors, and the self-employed

- Qualifying assets / 60 months

- Min 3 months of reserves

- Loan amounts up to $4 million

Prime Jumbo

A great fit for borrowers in search of large home loans for purchase or investment

- Loan amounts up to $3.5 million

- DTI up to 50%

- Cash out without limitations

Second Mortgage

A solution to secure additional funding with existing equity

- Loan amounts up to $500,000

- DTI up to 50%

- Owner-occupied, second home, or investment

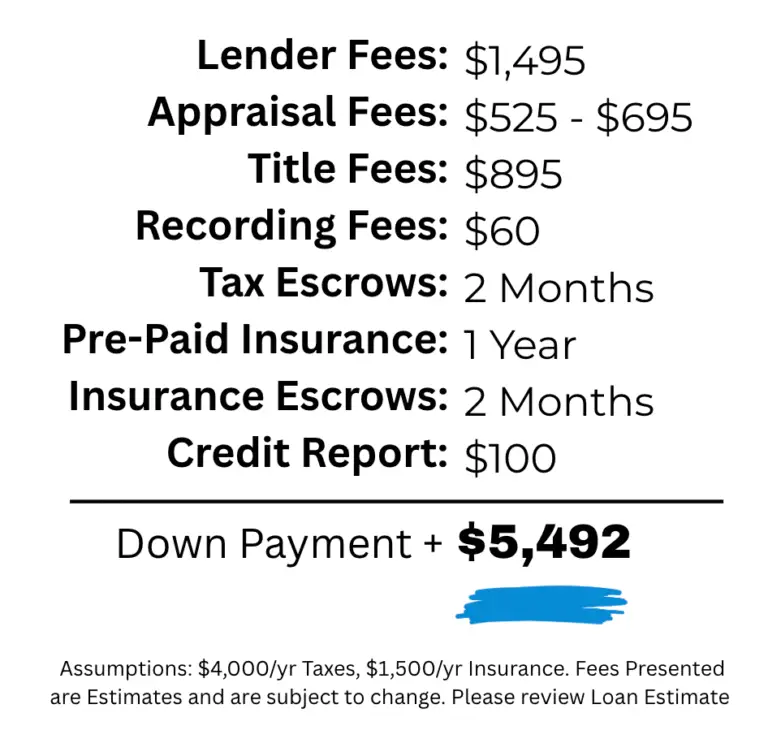

Closing costs